Knowledge Base

Tax Rates

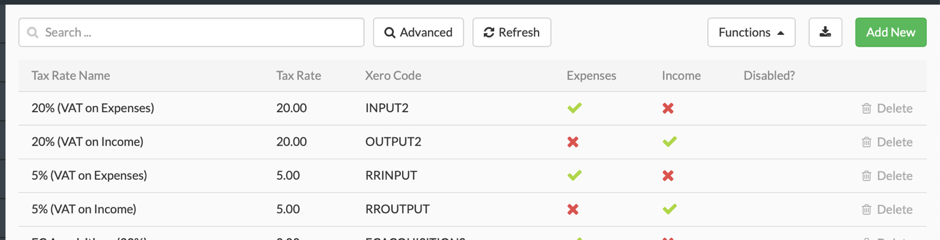

There are 16 preset tax rates in Workhorse. These should cover all the tax rates you need to operate in the UK. If you are operating overseas then you can add your own tax rates and delete those that don’t apply.

Add or Edit Tax Rates

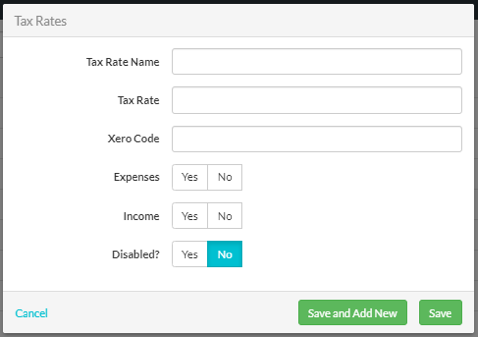

To add a new Tax Rate, click the Add New button in the top right-hand corner of the screen. Add Tax Rate details and click Save.

Note:

To be able to view or edit Tax Rates, you’ll need to have appropriate User Access to the Settings module.

To edit an existing Tax Rate, click on the entry you wish to change, make the changes and click Save. (See Tax Rates field explanations below for information about how to populate each field). An existing Tax Rate can also be disabled by setting the Disabled? button to Yes.

Tax Rates field explanations

| Field | Mandatory? | Description |

| Tax Rate Name | Y | The name of the tax you are entering. |

| Tax Rate | Y | The value of the tax in %. This must be entered in numbers. |

| Xero Code | N | This field is greyed out (disabled) and will be filled in if you connect your Workhorse application with Xero to sync your tax rates. See our Xero section for more information. |

| Expenses | N | Is this a tax on expenses? i.e. incoming goods. |

| Income | N | Is this a tax on income? |

| Disabled | Y | Is this tax in use? Only set this to Yes for obsolete taxes. |

Did you find what you’re looking for?

Here’s some related topics you might find helpful: