Avg Cost Calculation

There are two ways of calculating the average cost of stock available in Workhorse – FIFO and Average Cost. This valuation is displayed in the Avg Cost Price field of the Product, Kit, Assembly and Product Activity Module.

Note:

To change which method your system uses, contact Support or discuss this with your onboarding consultant during implementation.

FIFO Valuation Method

The FIFO (First In, First Out) method inherently depends on the In Stock figure recorded in the system, i.e., when

the In Stock quantity changes, the Avg Cost Price changes as well. In this way, Customer Orders affect the Avg Cost Price.

The calculation for this method involves multiplying the quantity added to stock (on a Purchase Order or Stock Adjustment) by the Cost Price or Adjustment Price. This figure is then divided by the In Stock quantity.

| Average Cost = | Quantity Added to Stock x Price |

| In Stock Quantity |

Note:

The stock cost price is unaffected by the Default Sell Price/Unit Sell Price.

Example:

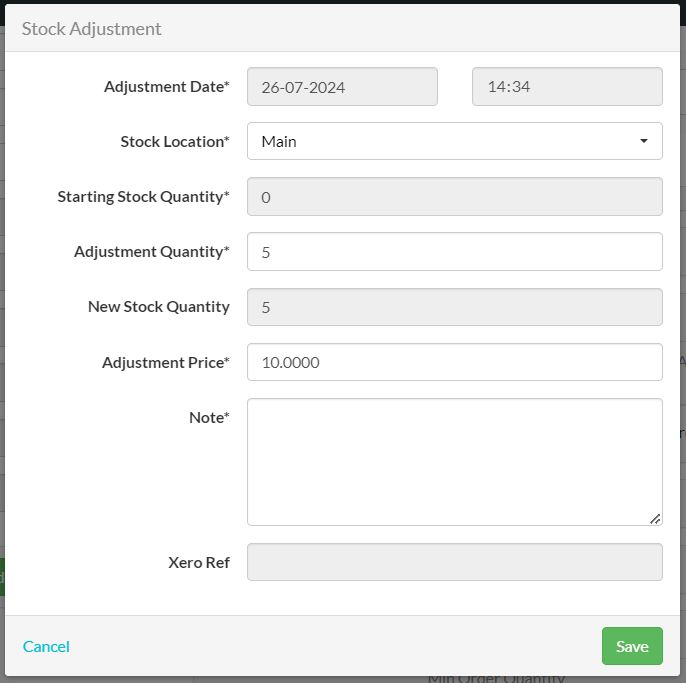

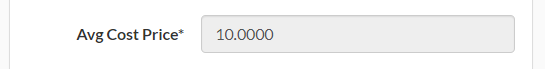

A new Product is added to the system and a Stock Adjustment is entered (Adjustment Quantity = 5, Adjustment Price = 10.00).

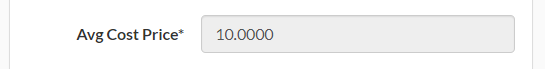

The Avg Cost Price on the Product updates to 10.00 once the Stock Adjustment is complete.

| Average Cost = | (5 x 10.00) |

| 5 |

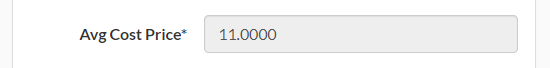

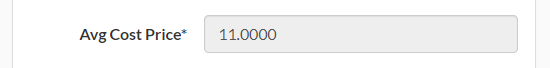

Then, 5 more of the same Product are ordered on a Purchase Order at a price of 12.00. Once the Purchase Order is marked Complete, the Avg Cost Price automatically updates to 11.00.

| Average Cost = | (5 x 12.00) + (5 x 10.00) |

| 10 |

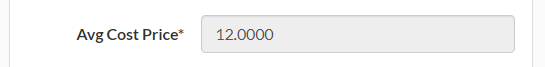

Later, 5 of the same Product are sold on a Customer Order and despatched. As the system is using FIFO (First In, First Out), the first 5 Products and their cost are removed from the average cost calculation and the Avg Cost Price automatically updates to 12.00.

| Average Cost = | (5 x 12.00) |

| 5 |

Average Cost Valuation Method

The average cost method calculates the average cost by dividing the total stock value by the In Stock quantity. This is the default method in Workhorse. The average cost at any time equals:

| Average Cost = | Total Stock Value |

| In Stock Quantity |

The difference with this valuation method is that sales (Customer Orders) don’t impact the average cost price.

Additional Purchase Orders and Stock Adjustments will affect the average cost calculation. The average cost will be multiplied by the current In Stock quantity to calculate the stock value before the Purchase Order is received. When the goods are received and the Purchase Order is updated to Complete, the previous stock value will be added to the Purchase Order stock value, to calculate the current stock value.

The average cost is then calculated as below:

| Average Cost t = | Stock Value t-1 + PO Stock Value |

| In Stock Quantity |

A new Product is added to the system and a Stock Adjustment is entered (Adjustment Quantity = 5, Adjustment Price = 10.00). The Avg Cost Price on the Product updates to 10.00 once the Stock Adjustment is complete.

| Average Cost = | (5 x 10.00) |

| 5 |

Then, 5 more of the same Product are ordered on a Purchase Order at a price of 12.00. Once the Purchase Order is marked Complete, the Avg Cost Price automatically updates to 11.00.

| Average Cost = | (5 x 10.00) + (5 x 12.00) |

| 10 |

Later, 3 of the same Product are sold on a Customer Order and despatched. Unlike with the FIFO method, the average cost is not affected. The Avg Cost Price remains at 11.00, however, the In Stock quantity is now 7.

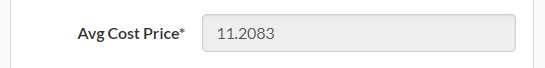

An additional Purchase Order is created for 5 more of the same Product at a price of 11.50. The Avg Cost Price automatically updates to 11.2083.

| Average Cost = | 77 + (5 x 11.50) |

| 12 |

Finally, another 10 of the same Product are sold on a Customer Order and despatched. The In Stock quantity is now 2, but the Avg Cost Price remains the same.

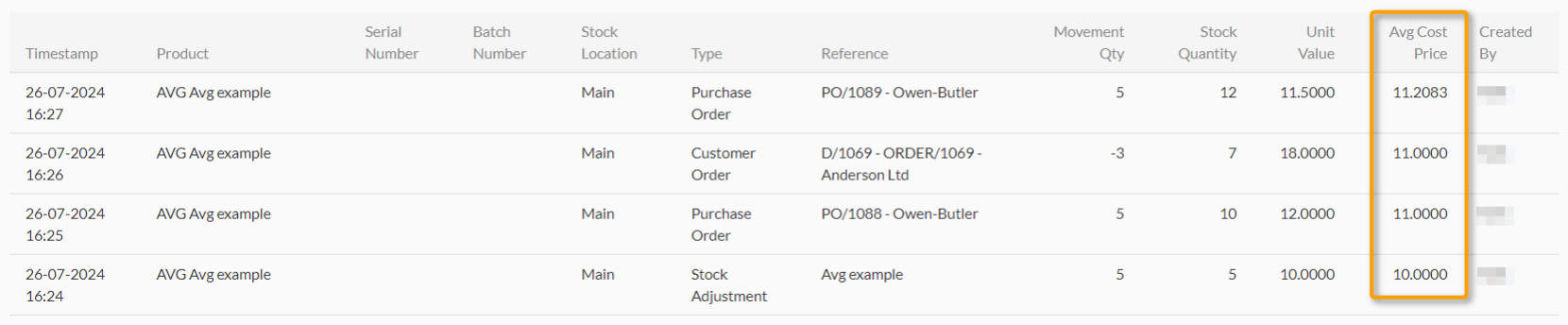

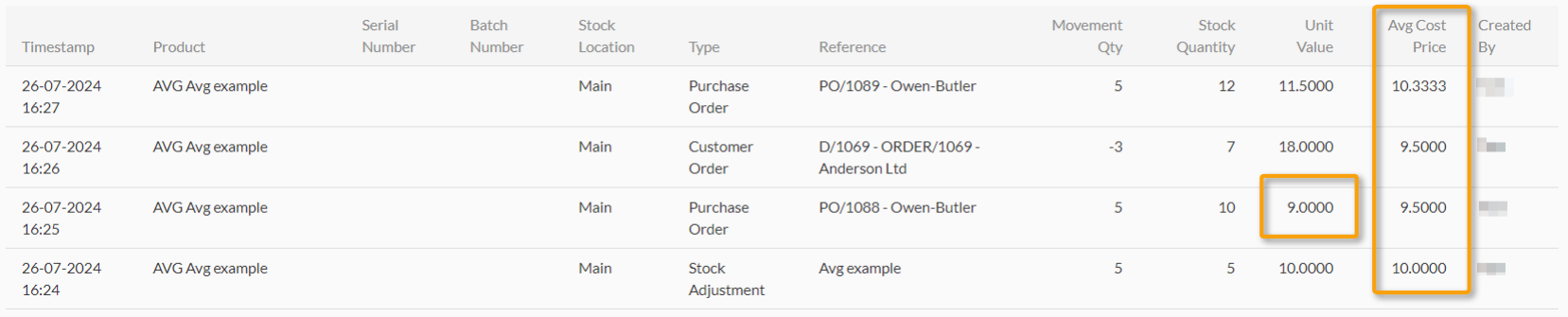

Using this method, if the Cost Price is updated on a Completed Purchase Order, the Avg Cost Price is recalculated for all subsequent transactions. This change is best viewed in the Product Activity Module which displays the updated Unit Value of the Purchase Order and the revalued Avg Cost Price for that record and all subsequent product activity transactions.

In the example below, the first screenshot shows the Product Activity Module before the Cost Price is updated on a Completed Purchase Order.

The second screenshot shows the Product Activity Module after the Cost Price is updated from 12.00 to 9.00 on a Completed Purchase Order.

Did you find what you’re looking for?

Here are some related topics you might find helpful: